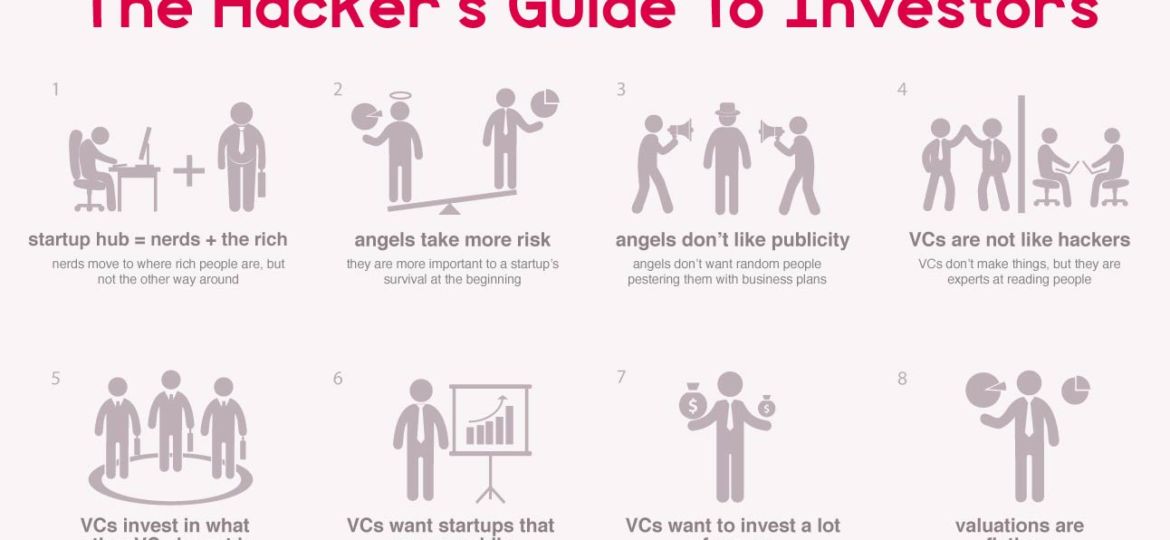

The Hacker’s Guide to Investors – Infographic

Venture Captial

We are not in a tech bubble, we are not in a tech bubble, we are not in…

4 Reports on Venture Capital Every Inspiring Unicorn Should Read

SXSW Interactive 2015 will be held from March 13-17th and I’m excited to speaking on the topic “Why…

Courtesy of: Bplans

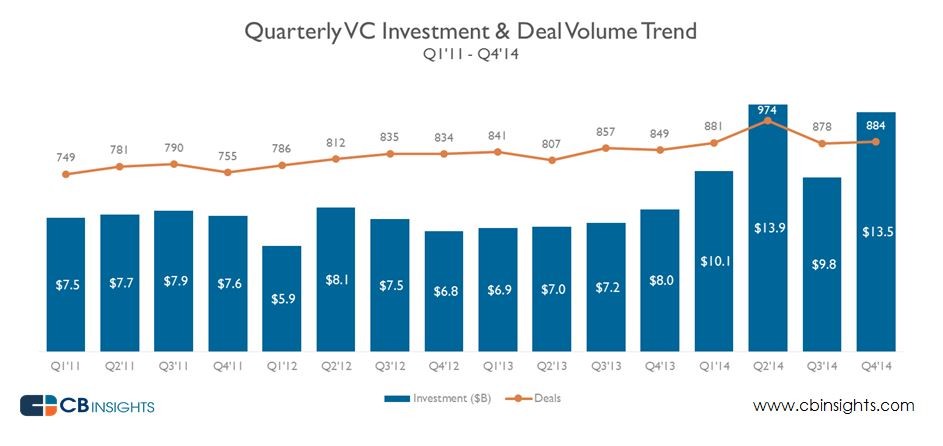

Are we in a bubble or not is the question on some LPs and venture capitalist minds. Regardless…

In 2013, venture capital financing hit $29.2 billion across 3354 deals. Behind the continued surge in early-stage seed…