When it comes to startups looking to raise money from venture capitalist there are two key elements that are closely looked at when reviewing the team and/or founder. One is the founder’s experience in terms of work, did they come from a Google or Facebook or what other startups or application have they launched. The other is a founder’s educational background. Did they attend and/or “drop out” from a Stanford, Harvard, Berkeley, or MIT. Both a founder’s experience and educational background matters to the investor (especially in Silicon Valley and the Bay Area) as by pedigree to what is described as an “A Plus team”. To an investor an “A Plus Team” is more likely to be successful based on years of previous deal flow with the background from one of the key “startup universities”. It’s even more relevant by some Silicon Valley/Bay area startups who will only hire Stanford CS grads or the VC firms that if you look at their portfolios it will be made of up 90% of Stanford alums.

All is not lost for the non-ivy league entrepreneurs. They say knowing is half the battle, so now you know what “part” of what venture capitalists look for and as an entrepreneur your job is to be super prepared in terms of domain experience, a great product, traction and more.

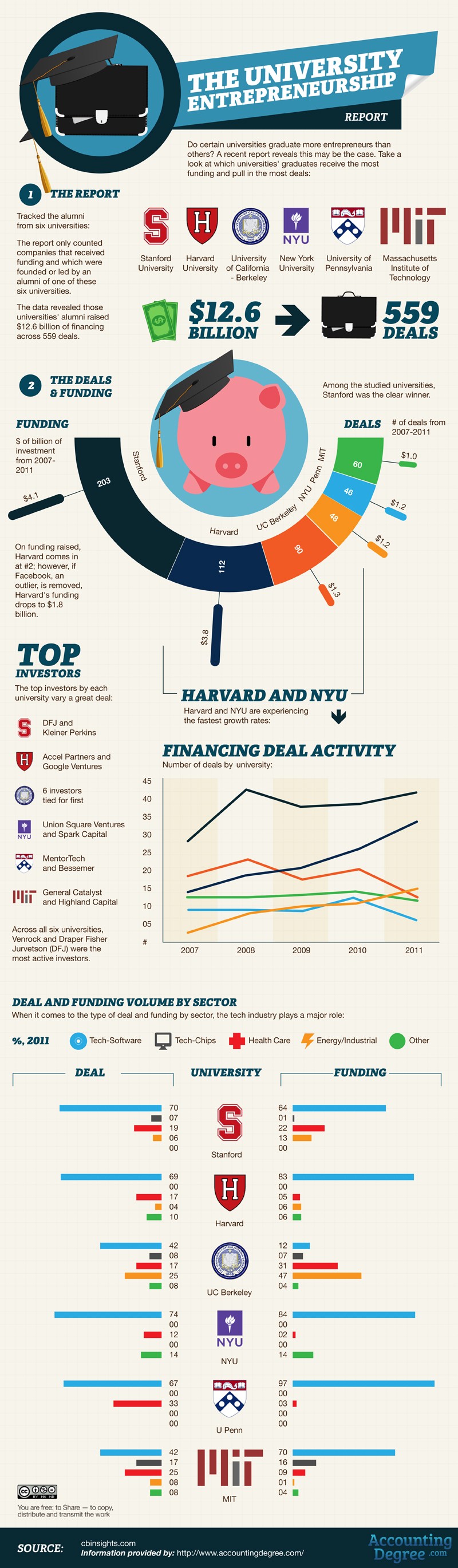

A recently published report from the AccountingDegree.com reveals which universities graduate the most entrepreneurs and how much funding these alumni get from investors and venture capitalists.